Spain Fails in Sustainability Due to Ageing Vehicle Fleet

Patxi Fernández

Friday, 7 November 2025, 13:05

Spain's transition towards truly sustainable mobility is hindered by an ageing vehicle fleet and significant reliance on private cars. This is one of the main conclusions of the report 'The Challenge of Sustainable Mobility in Spain: Between Ambition and Reality', prepared by consultancy BIP Iberia and presented at the Smart City Expo 2025.

The analysis warns that the current scenario seriously compromises air quality and public health, as the oldest vehicles account for the majority of pollutant emissions.

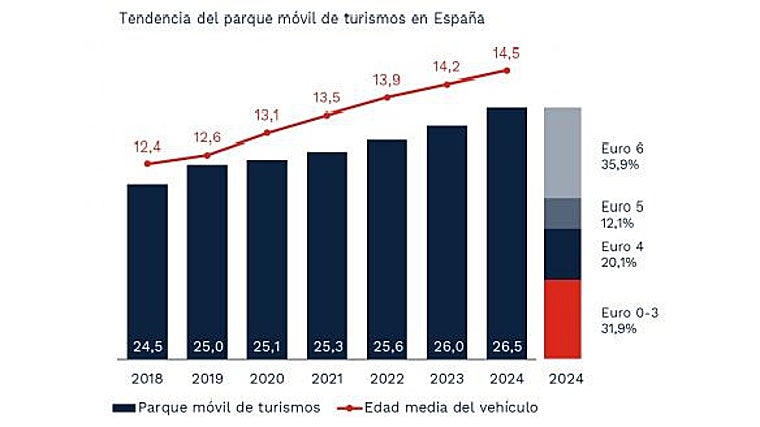

In 2024, the average age of cars in Spain reached 14.5 years, significantly exceeding the European average of 12.5 years. The most concerning aspect is the "quality" of this fleet, which already surpasses 26.4 million vehicles and continues to grow.

More than half of the vehicles on the road predate the Euro 5 standard. The oldest vehicles, representing just over half of the fleet, account for nearly 70% of road transport emissions. Over 8 million vehicles belong to the Euro 0 to Euro 3 categories, with emission standards far below current levels.

When adding Euro 4, more than half of the fleet does not meet the most stringent environmental standards. An analysis by BIP based on data from ANFAC and the EU reveals that specific models are pollution hotspots, with Euro 3 models responsible for more than 23% of emissions and Euro 0 for 11%. These figures highlight a significant barrier to reducing key pollutants such as carbon monoxide (CO), nitrogen oxides (NOx), unburned hydrocarbons (HC), and particulate matter (PM).

Electric Vehicles Struggle to Take Off

Spain maintains a high dependence on private vehicles, with 627 vehicles per 1,000 inhabitants in 2023, a figure that exceeds the European Union average (571). Of these, 527 were cars.

64% of journeys to work or educational centres are made by private vehicle. According to the report, another key factor is that public transport only accounts for 27%, while sustainable modes such as walking (13%) or cycling (9%) have a marginal presence.

The slow renewal of the fleet is attributed to a "market paralysis" caused by high prices, uncertainty about future regulations, and an economy that makes vehicle replacement difficult. As a result, cars age without being replaced, and emission reductions progress at a much slower pace than desired.

Ageing Fleet

Although over one million new cars were registered in 2024, electrification is not advancing as expected. Electrified vehicles (HEV, PHEV, and BEV) reached half of the market in 2024, an improvement from 43.9% in 2023, mainly due to non-plug-in hybrids (HEV), which increased from 31.9% to 38.6%. Pure electric (BEV) and plug-in hybrids (PHEV) have yet to consolidate, with shares of 5.6% and 5.8% respectively.

Nearly 13 million cars in Spain are over 15 years old

The average age of the car fleet in Spain continues to rise, reaching 14.5 years, as highlighted in the latest 2024 Annual Report by the Spanish Association of Automobile and Truck Manufacturers (ANFAC). Only four autonomous communities in Spain have a fleet age below the national average: Madrid (11.5 years), Catalonia (14.1 years), Valencia (14.2 years), and the Balearic Islands (14.2 years) have the most renewed fleets compared to the national average.

In contrast, the rest of the autonomous communities have older fleets, with Ceuta and Melilla having the oldest fleet at 17.7 years. They are followed by Castilla y León with an average of 16.6 years, and Extremadura and Galicia with 16.3 years.

In this regard, of the total cars on Spanish roads in 2024, 62.8% were over 10 years old, more than 16.6 million cars out of the 26.47 million in circulation. Specifically, 48.8% exceed the national average age, with over 15 years (12.9 million units).

Spain ranks 20th out of 27 European countries in electric vehicle penetration, with a market share of 5.6%, well below the European average of 13.6%. High prices, concerns about range, and a lack of charging infrastructure are the main obstacles. However, the latest data from ANFAC suggests a potential turning point. In the first half of 2025, PHEV and BEV registrations grew by 83%, doubling their market share to 20.8% compared to June 2024. This surge contrasts with the nearly flat trend from 2022 to 2024, suggesting that 2025 could mark the beginning of electric vehicle consolidation.

Electrified Vehicles

By the end of 2024, a total of 31,301,881 vehicles (cars, commercial, industrial, and buses) were on Spanish roads and cities, of which 494,967 were electrified (plug-in hybrids or pure electric), representing a 35% increase from the previous year. Nevertheless, these vehicles only account for 1.6% of the total fleet, 0.4 percentage points more than in 2023.

By autonomous communities, only Madrid, with 4.1% of its fleet electrified, exceeds the national average by more than 2.4 percentage points. Following in the top three are Catalonia with 1.7% and the Balearic Islands with 1.5% of the fleet electrified.

On the other hand, the rest of the autonomous communities still show a low presence of electrified vehicles in their respective fleets. Notable are the cases of Ceuta and Melilla and Extremadura, with barely 0.4% and 0.5%, respectively, of pure electric and plug-in hybrid vehicles on their roads.

The measures adopted so far have proven insufficient. "The transition has begun, but it is advancing slowly and risks becoming elitist and ineffective," the report concludes.

To achieve climate, economic, and health objectives, BIP Iberia emphasizes the need for a more balanced strategy that combines environmental sustainability, economic sustainability, and social impact. In conclusion, this report highlights the priority of addressing the vehicle fleet with a vision that integrates the electric vehicle as "an important, but not the only" piece in a more inclusive strategy aimed at real impact on citizens' health and quality of life.